APY vs APR : What Are The Differences?

Introduction

When comes to cryptocurrency staking you’ll likely see the interest rate expressed as an Annual Percentage Rate (APR) or an Annual Percentage Yield (APY). Even though these two terms sound similar, they function in different ways. In this article, we’ll discuss what are the differences between these terms, how you can calculate them and what you should be aware of.

Annual Percentage Rate (APR)

APR stands for Annual Percentage Rate, which is the amount of interest you receive annually on your investments.

The formula to calculate APR is the following:

APR= (PI x ROI x T) / 100

*PI - principal investment*

*ROI - the rate of interest (yearly)*

*T - time (number of years in most cases)*

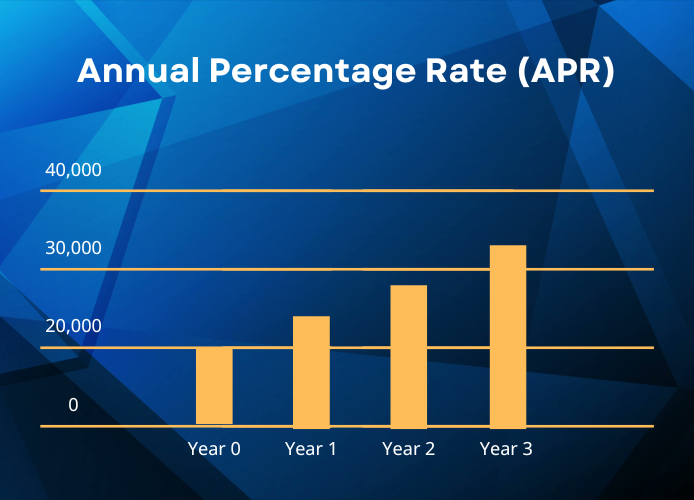

To make it more clear, let’s see an example. Let’s say you invest an amount of $20,000 in a financial account with a 20% rate of interest. In that case, your interest is calculated by multiplying the APR percentage with the initial -often referred to as “principal”- investment.

Therefore in one year, the total balance of your account will be $24,000. By the end of the second year it will be $28,000, by the end of 3rd year $32,000 and so on.

Annual Percentage Yield (APY)

APY stands for Annual Percentage Yield which is the actual rate of return earned on an investment but taking into account compound interest.

Now, before examining APY, it is important to understand the term compound interest. Compound interest means earning interest on the previously earned interest. If the financial provider adds interest to your account monthly, then for each month of the year the APY, will apply to the already increased investment. In the DeFi world, staking one’s coins would allow you to receive rewards from the network and add them to the overall staked coins so that you receive a higher profit next time.

The formula to calculate APR is the following:

APY = [(1 + PR/n)^n] -1

PR - the period rate

n - the number of compounding periods

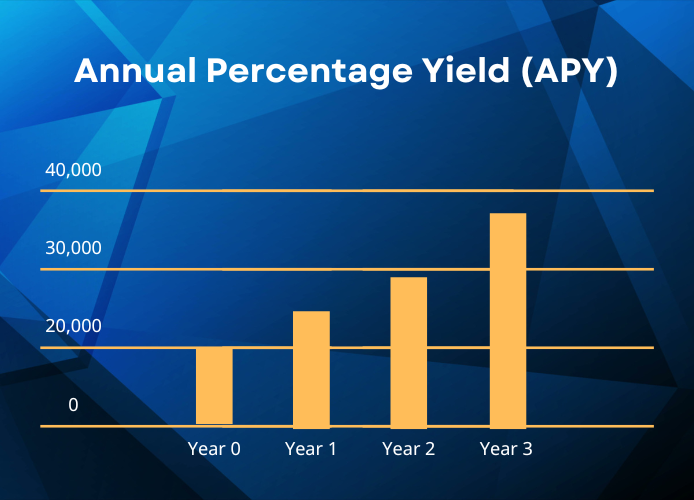

Let’s get the same example as before and say you deposit a principal investment of $20,000 with an interest rate of 20% and monthly compounding. In year one, you will have $24,388 in your account, in the second year you will have $29,738 and by the end of 3rd year, you will have $36,263.

APR vs APY

As you can understand, APY and APR are both ways of measuring the yield on an investment, but they result in different profit amounts because of the compounding effect.

Different products offer their rates in either APR or APY. As the examples above show, interest can be increased when it is compounded. However, be aware that investments with higher APY will not always bring you more interest than the ones with a lower APR. Because of this discrepancy, it’s important to use equal terms when you compare products, so be sure to make the correct conversion first in order to get the equation right.

Furthermore, it is essential to check the compounding periods when comparing two Defi products with APY as one may offer a monthly compounding period but the other a yearly one.

When it comes to crypto staking, you always have to bring the inconstancy of the cryptocurrencies into the equation. If the value of the asset you stake drops within the period rate, then your investment will end up being lower than your initial investment.

Closing Thoughts

To conclude, APR and APY have slight differences in how they work but what you choose will determine the outcome of your investment. Always do your own research before investing your money and calculate your interest using the formulas explained above. Or you can always use online tools that are available online to make your life easier.

.png%3Falt%3Dmedia&w=640&q=75)